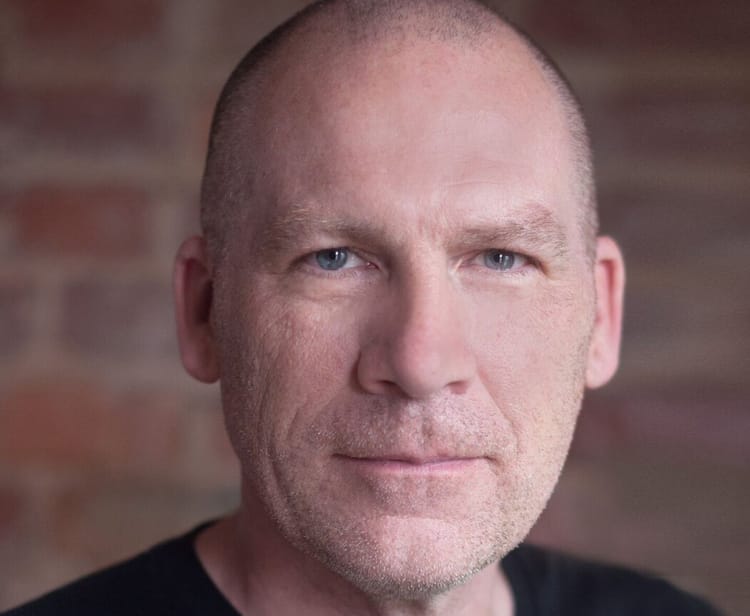

Greenfield Communications is now Greenfield Public Relations

Greenfield Communications, founded in Duluth in 2005, has changed its name to Greenfield Public Relations.

Owner Steve Greenfield said that while “Communications” encompassed its public relations, advertising, focus group research and other communications-related services, the name did not reflect the specialty for which the company is best known.

“I’ve always appreciated our reputation for handling tough challenges that threaten our clients’ reputations and success,” said Greenfield. “We do this by incorporating PR approaches that best match each need, so renaming the company as Greenfield Public Relations better reinforces that distinction.”

Greenfield's PR approaches include crisis communications, media relations, government relations, referendum strategizing and community engagement, among others.

The company’s new web address is www.GreenfieldPR.com and its phone number remains 218-260-7283. Greenfield Public Relations also serves clients from its downtown St. Cloud office.

ALLETE Senior Vice President & Chief Financial Officer Steven W. Morris to retire mid-year as part of a planned transition

ALLETE, Inc. (NYSE: ALE) announced that Chief Financial Officer Steven W. Morris will retire later this year after a distinguished nearly 25-year career with the company. In the interim and as part of an orderly succession plan, Morris, 63, will remain with the company until July.

Morris joined the Duluth-based company in 2001 and was promoted to Senior Vice President and Chief Financial Officer in Feb. 2022 after serving in numerous key strategic roles throughout his tenure.

“Steve has been an integral member of the ALLETE team during his long career. His ethical, strategic, steady and consistent leadership is a strong reflection of how we do business here at ALLETE,” said CEO Bethany Owen. “Steve has always worked to position this company for sustainable success with a commitment to our customers, investors and our employees, and he has been an integral part of executing ALLETE’s strategic goals. His ability to engage with all stakeholders, from investors to customers to employees and to lead across multiple functions of the company is a rare combination, and we are grateful to Steve for his many contributions to ALLETE.”

Morris joined the company as Minnesota Power’s manager of financial reporting and budgeting and has held roles with increasing responsibility during his tenure. He was appointed director of internal audit for ALLETE in 2005, named director of accounting in 2010, and in 2014, he was promoted to controller, a position he continued to hold until 2021 when he was named Chief Financial Officer and Senior Vice President with responsibility and broad oversight of all aspects of accounting, financial reporting, internal audit and controls, treasury, risk, business development and investor relations.

“The ALLETE team is world-class, and this company is destined to achieve even greater success. I am fortunate to have been closely involved in the development and continued execution of the most exciting strategy in company history,” Morris said. “ALLETE has never been stronger or more well positioned for success with excellent partners in Canada Pension Plan Investment Board and Global Infrastructure Partners, which will provide the company with greater access to capital to continue its leadership in the nation’s ongoing clean-energy transformation.”

Prior to joining ALLETE, Morris spent 16 years with the public accounting firm RSM LLP (formerly McGladrey and Pullen), where he rose to the position of senior manager.

A graduate of the University of Minnesota Duluth, Morris is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants and the Minnesota Society of Certified Public Accountants. He previously served as a board member and treasurer for the Head of the Lakes United Way.

Owen said Morris’ planned retirement is part of an orderly succession plan, and that she has initiated steps to identify a new chief financial officer and expects to do so later in the first quarter.

As previously announced, under the terms of the merger agreement CPP Investments and GIP will acquire all outstanding common shares of ALLETE for $67 per share in cash, or $6.2 billion, without interest, including the assumption of debt. After the transaction closes, ALLETE will remain locally managed and operated.

Its utilities, Minnesota Power and Superior Water, Light and Power, will continue to be regulated by the Minnesota Public Utilities Commission, the Public Service Commission of Wisconsin and FERC. The acquisition is not expected to impact retail or municipal rates for utility customers.

ALLETE expects to complete the transaction in mid-2025, which remains subject to certain regulatory approvals and other customary closing conditions.

Member discussion