Half of Minnesotans struggle to pay rent, study finds

By Christopher Ingraham, Minnesota Reformer

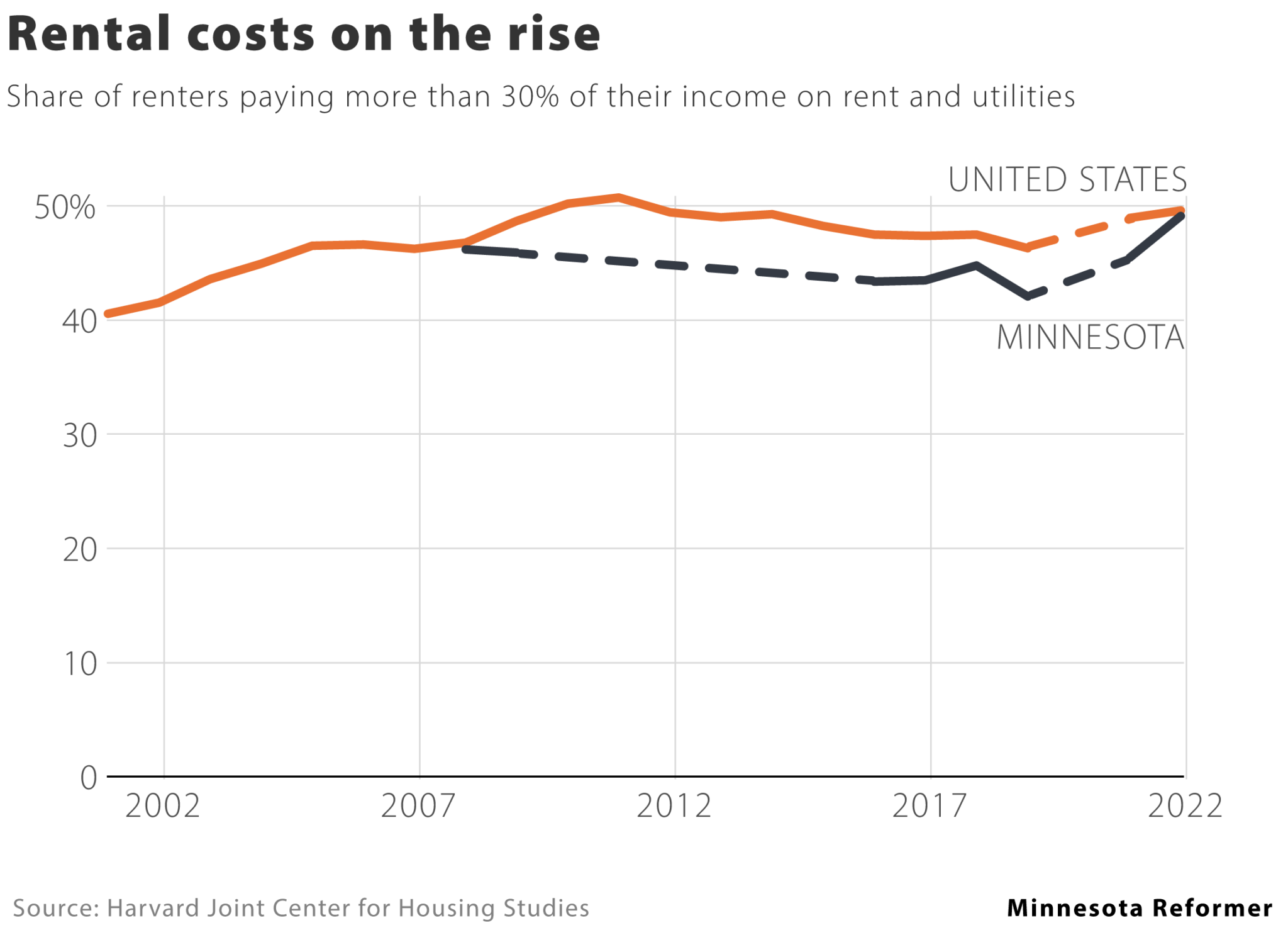

Rental costs are straining the limits of affordability for almost half of renters in Minnesota, according to the latest rental affordability report from the Harvard Joint Center for Housing Studies.

The share of Minnesota renter households paying more than 30% of their income on rent and utilities rose to 49% in 2022, according to the center’s analysis of U.S. Census Bureau data. More than 26% of Minnesota renters now spend over half their income on rent and utilities, putting them in the “severely” cost-burdened category.

Rates of unaffordability are particularly high in the southeast corner of the state, approaching or surpassing 55% in Rochester and many surrounding areas. Severe cost burdens, on the other hand, are highest in Duluth (32%), Mankato (34%) and Fergus Falls (35%).

Those high costs have contributed to an increase in homelessness in the state. Close to 8,400 Minnesotans were without a residence in 2023, according to the report, considerably higher than the pre-pandemic average.

Nationwide, “the number of renters living in unaffordable housing has reached an all-time high and includes households across the income spectrum and around the country,” the report’s authors write. “The growing shortage of units affordable to renters with the lowest incomes is only worsening the affordability crisis.”

Still, Minnesota is doing some things right. The Twin Cities added thousands of new units to the regional housing supply in recent years, which helped keep rent increases lower than those seen in many comparable markets.

St. Paul and Minneapolis also removed parking requirements from their zoning codes in 2021, which many analysts credit with improving overall affordability. Forthcoming legislation would ban parking minimums statewide if it passes.

Lawmakers committed $1 billion in new housing spending during the last legislative session, covering rental assistance, affordable housing, down payment assistance and more.

The Harvard affordability data only go through 2022 and don’t reflect many of the more recent changes in the housing markets in the Twin Cities and statewide.

Minnesota Reformer is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Minnesota Reformer maintains editorial independence. Contact Editor Patrick Coolican for questions: info@minnesotareformer.com. Follow Minnesota Reformer on Facebook and Twitter.

Member discussion